Automated AI Trader

Problem Statement

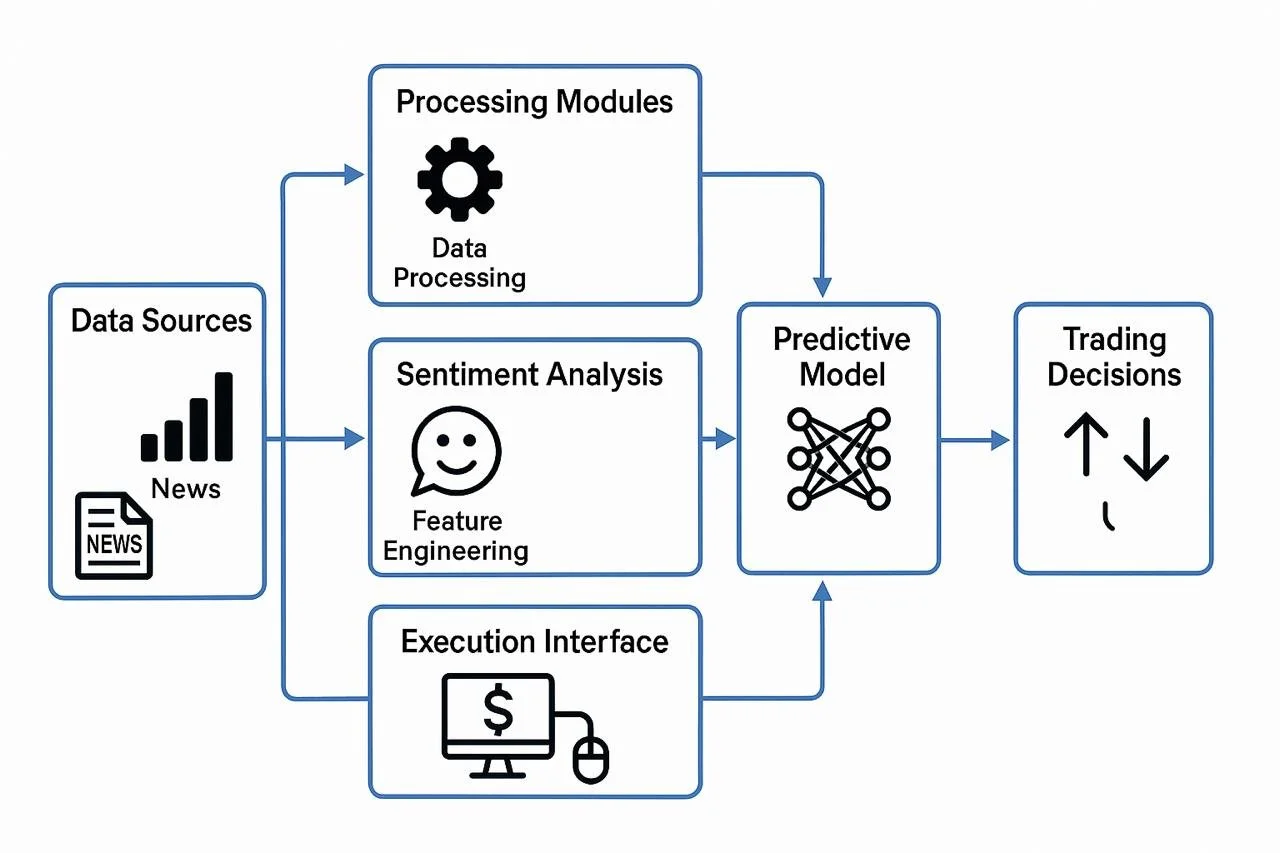

Traditional algorithmic trading systems heavily rely on quantitative technical indicators, which can overlook critical insights derived from real-time, unstructured data such as financial news and company reports. This lack of integration between technical analysis and qualitative sentiment often leads to reduced performance, particularly during periods of rapid market sentiment shifts. There is a need for a system that bridges this gap to make more holistic and accurate trading decisions.

Proposed Solution

Design and implement an integrated trading platform that combines:

A Long Short-Term Memory (LSTM) network for historical price trend prediction and technical analysis.

A Large Language Model (LLM) capable of parsing and interpreting news articles, financial reports, and other textual data to gauge market sentiment.

A real-time decision engine that merges insights from the LSTM and LLM outputs to make dynamic trading decisions.

Automated trade execution via integration with broker APIs for real-time order placements.

Technical Approaches

LSTM-Based Price Prediction

Input Data: Historical OHLCV (Open, High, Low, Close, Volume) data, augmented with derived technical indicators such as RSI, MACD, and Bollinger Bands.

Architecture: Multi-layer stacked LSTM model with attention mechanisms to enhance focus on critical time steps.

Training Strategy: Supervised learning using Mean Squared Error (MSE) as the loss function. Hyperparameter optimization via Bayesian search.

Challenges: LSTM models require substantial training data and may not generalize well to black swan events without retraining.

LLM-Based Sentiment Analysis

Input Data: News APIs, RSS feeds, earnings call transcripts, and financial filings.

Model Fine-tuning: Pre-trained models such as FinBERT further fine-tuned on a domain-specific corpus of financial documents.

Sentiment Scoring: Outputs a normalized sentiment score ranging from -1 (very negative) to +1 (very positive).

Deployment Strategy: Batch inferencing for bulk data and real-time inferencing for breaking news events.

Challenges: Requires continual fine-tuning to adapt to linguistic shifts and jargon in financial markets.

Integrated Decision Engine

Architecture: A rule-based or reinforcement learning-based meta-controller that integrates LSTM predictive signals and LLM sentiment scores.

Signal Processing: Weighted signal aggregation based on model confidence scores and market volatility conditions.

Output: Buy, Sell, or Hold signals with confidence intervals.

Challenges: Conflicting model outputs need sophisticated arbitration mechanisms to avoid trade indecision.

Automated Trading Execution

Integration: RESTful API connections to brokers like Alpaca, Interactive Brokers, and Tradier.

Execution Engine: Implements pre-trade checks, slippage control, stop-loss, and take-profit mechanisms.

Logging and Compliance: Full trade audit trails and compliance with regulatory requirements such as SEC and FINRA rules.

Chosen Approach

Integrated LSTM and LLM system with a real-time decision engine and automated trade execution is chosen. This approach maximizes informational intake by leveraging both structured and unstructured data, allowing for both predictive and reactive market strategies. LSTM models capture the historical price action, while LLMs ensure that contextual market-moving news is not ignored. The decision engine integrates these heterogeneous signals into coherent trading actions, and the automated executor ensures seamless market participation without manual intervention.

This application is an end-to-end automated AI stock trading platform that leverages cutting-edge technologies to deliver superior market predictions and actionable insights. At its core, the system integrates real-time stock market data via APIs with historical market trend analysis to identify patterns and anomalies that inform strategic trading decisions.

To gain a holistic view of the market, the system incorporates Large Language Model (LLM)-powered sentiment analysis that continuously scans financial news articles, earnings reports, and social media platforms (like Twitter and Reddit) to assess public sentiment and its potential impact on stock prices. This allows the system to account for non-quantitative factors that often drive market volatility.

The predictive engine is powered by a Long Short-Term Memory (LSTM) neural network, which is constantly refined and retrained using the latest market and sentiment data. This recurrent neural network architecture is particularly well-suited for time-series forecasting and enables the system to learn from both short-term fluctuations and long-term trends.

Users benefit from detailed, data-driven insights that go beyond traditional technical analysis. The platform provides visualized predictions, risk assessments, and trade recommendations that would be difficult to derive manually. By combining quantitative indicators with natural language insights, the system empowers users—whether retail investors or institutions—with a competitive edge in the stock market.